Property Taxes

The Town of Carberry's taxation year runs from January 1st - December 31st.

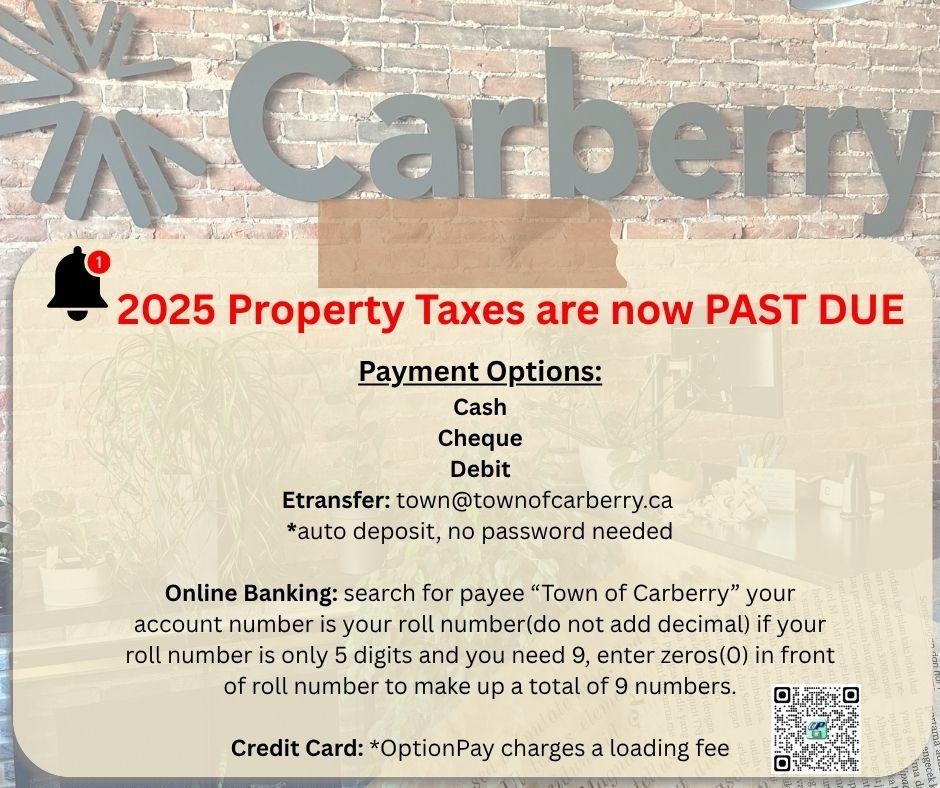

Deadline for payment

Property taxes are due September 30th

Penalties of 1.25% late fees will be charged on unpaid taxes and will be added the first business day of every month after September 30th.

Payment Options

Mail: Enclose the bottom of your tax bill with your cheque or money order made payable to:

Town of Carberry

Box 130

Carberry, MB

R0K 0H0

Note: payments are recorded on the date they are received, not mailed, so ensure you post in sufficient time for delivery.

Post dated Cheques: Post dated cheques can be mailed to the above address or dropped off at the office at any time.

In Person: Our office is located at 44 Main Street, Carberry

Please bring your tax notice(s) with you.

We accept cheques, cash, or debit.

NEW We are now accepting Credit Cards!

Online Banking: When adding Town of Carberry as your payee, search for "Town of Carberry".

Your account number is your roll number ( do not enter the decimal). If your roll number is only 5 digits and you need 9, enter zeros (0) in front of your roll number to make up a total of 9 numbers.

E-transfer: We have auto deposit for e-transfers. Please use email address town@townofcarberry.ca or contact the office for more information.

***Please note there are daily limits for e-transfers, so pay early!***

Credit Card:

Make a payment to the Town of Carberry, scan the QR code or click on link below:

Click here to make a credit card payment

OptionPay: Introduction to Residents

The Town of Carberry is pleased to announce that it will now accept payment by VISA or MasterCard Credit or Debit card for select municipal bills/services.

Through OptionPay, our third-party payment processor, for a nominal processing fee you can make card payment through our website using the "Online Bill Payments" link, on your smart phone by scanning the QR Code (For smartphones - auto-fill and new card scanning options available in Chrome, Firefox, and Safari Web Browsers) via phone to the finance group and in our Town of Carberry office. All processing fees are charged by OptionPay and are not received by the Town of Carberry.

Utilizing OptionPay enables the Town of Carberry to keep our overall payment acceptance processing costs down yet provide individual residents to utilize their credit/debit card for payment of municipal bills/services.

Currently, for the Town of Carberry, the following bill types can be paid through OptionPay:

- Accounts Receivable (invoice)

- Property Taxes

- Campground

- Facility Rentals

All payments will be received by the Town of Carberry within 48 business hours, so please be sure to allow this processing time when making your payment. Also ensure to know your daily and/or transaction processing limit when making credit card payments.

Credit card Rewards are earned on entire purchase, including fees.

For optimal performance please use Google Chrome or Firefox web browser when accessing OptionPay.

Our office accepts prepayments in any amount for taxes throughout the year.

Early bird rates: -1.5% to June 30th, -1% to July 31st and -0.5% to August 31st.

Tax Statements

Tax statements are mailed out annually in June. If you are moving, please provide your new civic address and complete mailing address. It is crucial that the Town is promptly informed of any change in ownership or mailing address to ensure proper forwarding of the tax statement.

If you receive a tax bill for a property you no longer own due to a change in ownership, please forward the tax bill to the current owner or return it to the Town Administrative Office immediately. Please note that not receiving a bill does not exempt an owner from the responsibility of paying taxes or from liability for any late payment penalties